July 1, 2024

Will silver reach $100 an ounce or INR 2500 per 10g?

There is speculation on whether silver will reach $100 an ounce or INR 2500 per 10g, bringing uncertainty to the precious metal market.

Welcome to my weekly blog post! I am thrilled to share my insights on the current state of the silver market and address the burning question on everyone's mind - will the price of silver reach $100 an ounce or INR 2500 per 10g?

Let's analyze the market forces and explore silver's potential as an investment beyond its beautiful ornaments.

Silver's Allure: More Than Just Shine

We all know and love silver for its dazzling jewelry. But there's a whole other side to this precious metal.

Silver's industrial applications are vast, from solar panels and electronics to medical equipment and water purification.

This dual role as a beautiful adornment and a crucial industrial component fuels its demand.

Demand on the Rise: A Global Phenomenon

The investment demand for silver has surged as investors seek safe-haven assets amid global economic uncertainties. Silver ETFs and physical silver purchases have seen a marked increase. For instance, India's silver imports jumped by 20% in 2023, reflecting the growing investor interest (ET Bureau, 2023).

India, the world's largest silver consumer, continues to witness a surge in demand. Our country gobbled up a staggering 2,700 tonnes in 2023 (World Silver Council).

This hunger for silver isn't limited to India. China, another major consumer, is experiencing similar growth.

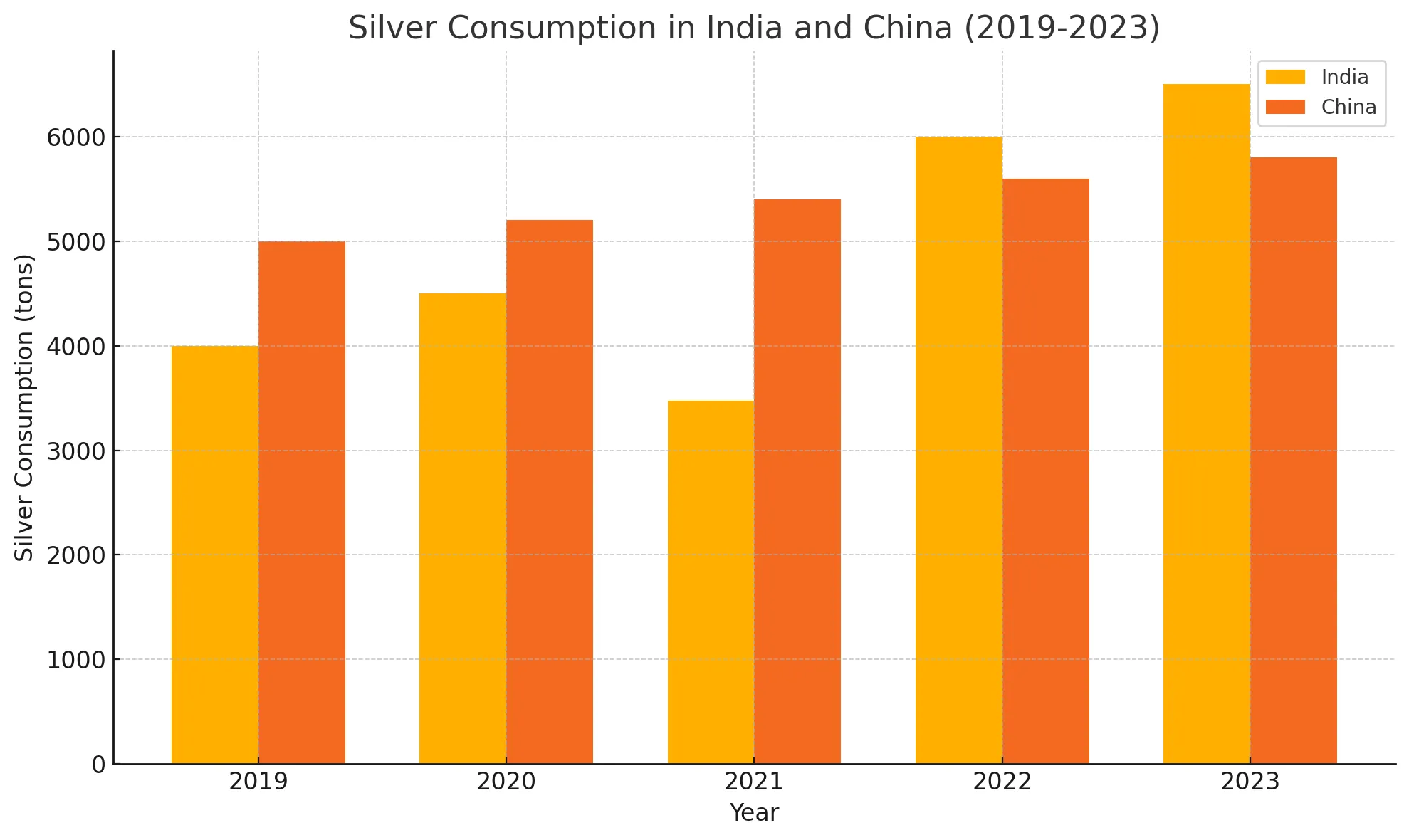

The below bar chart comparing silver consumption in India and China from 2019 to 2023 reveals some fascinating trends. In India, silver demand has skyrocketed, especially in 2022 and 2023, thanks to booming industries and rapid growth in the solar energy sector, hitting record highs.

Meanwhile, China’s silver consumption has grown steadily, from 5,000 tons in 2019 to 5,800 tons in 2023, driven by constant industrial use and advancements in green energy. These trends highlight different reasons for the rising silver demand in these two countries.

India's sharp increase is tied to its growing solar projects and jewelry industry, while China's gradual rise is due to its strong industrial base and tech advancements. This comparison paints a vivid picture of how silver is being used in different ways across these major markets.

Disclaimer: This chart is based on my analysis and interpretations of available data, and results may differ based on individual perspectives and additional data sources.

Global Uncertainty: A Friend to Silver?

Geopolitical tensions and economic wobbles often push investors towards safe-haven assets like gold and silver. We saw this during the initial stages of the COVID-19 pandemic in 2020, when silver prices skyrocketed. While the situation has stabilized somewhat, underlying uncertainties persist.

Global monetary policies, particularly in major economies like the USA, have a significant impact on silver prices. Rising inflation rates globally have led investors to hedge their portfolios with silver.

The Supply Squeeze: A Cause for Concern?

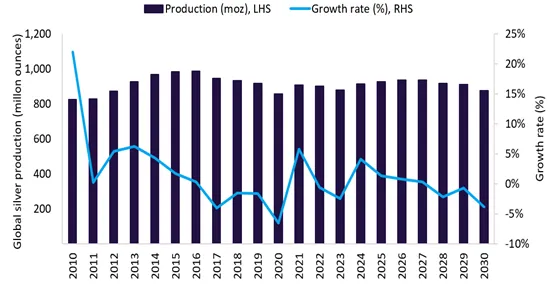

The silver mining industry faces its own challenges. Several major mines are nearing depletion, while exploration for new ones has slowed down. While the relationship isn't always a perfectly straight line, history suggests that limited supply often leads to price appreciation.

Global silver mine production is expected to rebound in 2024, with a 4.1% growth rate to 916.1 million ounces, however, silver mine production is expected to fall to 876.6 million ounces by 2030 (GlobalData).

Technical Analysis

Technical analysis involves studying price charts and market data to forecast future price movements. Silver has shown a strong support level around INR 800 per 10g and resistance around INR 1000 per 10g.

Breaking past this resistance could pave the way for prices to reach INR 2500 per 10g. Analysts use various tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to predict such movements.

Will Silver Touch The Mark? A Measured Approach

While the factors mentioned above paint a bullish picture, predicting the exact price point is tricky. The silver market is influenced by various external forces, including the US dollar's strength and fluctuations in global industrial production.

Here's my take: Reaching the mark in the immediate future might be a stretch. However, with the ever-increasing demand and potential supply constraints, silver has the potential to reach this mark in the mid to long term (think 3-5 years).

Final Thoughts

While predicting exact price levels in the volatile world of investments is challenging, the underlying strength of silver as a precious metal continues to attract investors worldwide. As we witness the evolving landscape of the silver market, staying informed and making strategic decisions are key to maximizing returns.

Lets stay tuned to the market developments and keep a close eye on the price movements of silver. Remember, silver is more than just a piece of jewelry - it is a promising investment opportunity waiting to be explored.

Beyond the Blog: Deepen Your Silver Knowledge

My aim is to empower you to make informed choices. Stay updated on the latest trends and insights in the silver market, I recommend visiting Silver Institute and Metals Focus for comprehensive reports and analyses.

*Information available on the below links has been used to do the analysis of silver consumption in India and China: