July 21, 2024

Silver above Rs 93,000: Is it an investment opportunity or a fleeting trend?

With silver prices reaching above Rs 93,000, many are questioning whether it is a worthwhile investment opportunity or just a passing trend. Investors are considering the potential risks and rewards of investing in silver at this high price point.

As silver prices soar above Rs 93,000 per kilogram, investors are at a crossroads: Is this a golden opportunity for investment or just a fleeting trend?

This blog post will explore the current silver market, analyze key factors driving prices, and provide valuable insights for both seasoned investors and those new to the silver market.

Let's delve into the factors driving the silver price and explore its potential as an investment vehicle.

Tailwinds Propelling Silver

Several key forces are contributing to silver's current momentum:

- Weakening Dollar: A declining US dollar strengthens other assets, including silver. According to a recent Federal Reserve report Federal Reserve, June 2024 Monetary Policy Report, the expectation is for a continued weakening of the dollar through the end of 2024. This could provide further support for silver prices.

- Industrial Demand: Silver finds extensive

use in various industries, from electronics and solar panels to

automobiles and medical equipment. In 2023, Industrial demand for silver reached a record high, driven by a

20% increase in the electrical and electronics sector alone. This trend is expected to continue, with annual industrial demand

projected to grow by 5% over the next five years (Silver Institute).

- Geopolitical Tension: Uncertainty in the global landscape can push investors towards safe-haven assets like silver. At a time in 2021, 27 conflicts were ongoing globally (Council on Foreign Relation, Visual Capitalist), which has led to heightened market anxieties, leading to increased interest in silver.

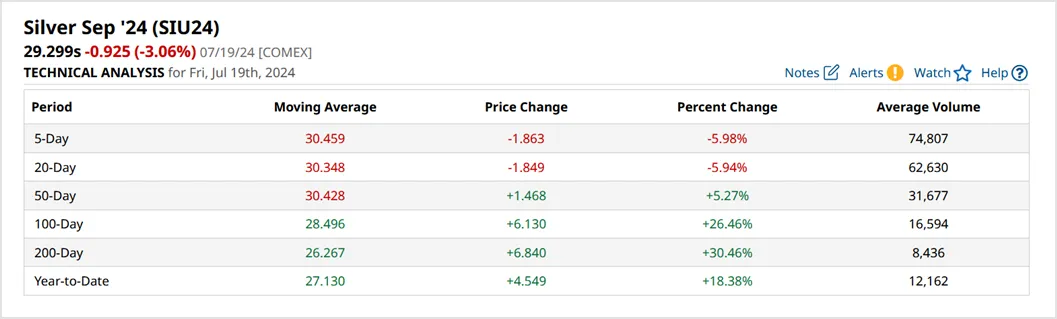

Technical Indicators Flashing Green

Technical analysis also paints a bullish picture:

- Upward Trend Line: On the daily chart, silver has traced an uptrend line, suggesting continued momentum.

- Key Averages Support: Silver trades above all its key moving averages (50-day, 100-day, and 200-day), indicating a strong uptrend.

- RSI and MACD: The Relative Strength Index (RSI) remains above 60, and the Moving Average Convergence Divergence (MACD) has exhibited a bullish crossover, suggesting potential for further price appreciation.

Silver: Beyond the Bling

Many in India associate silver primarily with jewelry. However, silver's industrial applications are vast and growing.

According to the Silver Institute, over 50% of global silver demand comes from the industrial sector (Silver Institute). This industrial demand is likely to rise further due to:

- Green Revolution: The growing focus on renewable energy sources like solar power significantly increases silver consumption in solar panels. The World Economic Forum estimates that the global solar photovoltaic (PV) market will grow by 16% annually between now and 2030 World Economic Forum, Future of Jobs Report 2020. This translates to a significant increase in silver demand for solar panel production.

- Technological Advancements: The ever-evolving technology sector relies heavily on silver for its conductive properties in various electronic components. According to a recent report by Gartner, the global semiconductor market is expected to reach $680 billion by 2025 (Gartner). This surging demand for semiconductors will inevitably lead to a rise in silver consumption for their production.

Investing Options for Silver Enthusiasts

- Physical Silver: Invest in silver coins or bars for direct ownership. This offers tangible ownership but comes with storage and security costs.

- Silver ETFs: Exchange Traded Funds (ETFs) offer a convenient and cost-effective way to gain exposure to silver prices without the hassle of physical storage. Research and choose reputable silver ETFs listed on Indian stock exchanges.

- Silver Futures: For experienced investors, futures contracts allow for leveraged trading, but carry higher risks. Futures contracts involve margin requirements and can lead to significant losses if the market moves against you. Only consider futures trading if you have a strong understanding of derivatives and a high-risk tolerance.

The Final Word

Silver's recent surge and strong fundamentals suggest it has the potential to be a valuable addition to your investment portfolio, particularly for investors seeking diversification and exposure to the growing industrial demand for silver. However, due diligence, a well-defined investment strategy, and a long-term perspective are crucial for success.

Remember, I'm here to navigate the silver market with you. In the next post, we'll delve deeper into specific silver investment strategies tailored for the Indian market.