July 2, 2024

The Impact of Silver's Scarcity: An In-Depth analysis

A comprehensive analysis on the impact of silver scarcity, highlighting its implications on various industries and economies.

As a long-time investor and your friendly neighborhood silver guru, we are going to delve into a topic that's been sparking a lot of conversation lately silver scarcity and examine how can it affect prices, market trends, and the broader economy.

This analysis will provide a comprehensive understanding of why silver remains a valuable asset beyond its traditional use as jewelry.

Understanding Silver Scarcity

Silver scarcity refers to the limited availability of silver due to various factors such as declining mine production, increasing industrial demand, and geopolitical influences.

Over the past decade, silver production has not kept pace with demand, leading to a tightening supply.

In 2021, global silver mine production was approximately 24,000 metric tons, a slight increase from 2020 but still below the peak production years of 2015-2016 (Silver Institute, 2021).

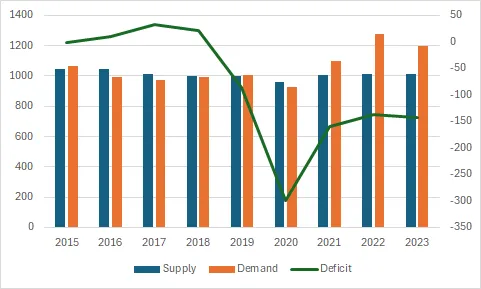

The below chart indicates the rising demand, possibly due to factors like industrial applications, technology advancements, and investment. Meanwhile, the flat supply line indicates that production isn't keeping up.

This imbalance could push the market into a deficit, meaning consumption outpaces production. This is a potential buying opportunity for investors looking to capitalize on a rising silver price.

Read this: India's Silver Trade: Import & Export Trends

Factors Contributing to Silver Scarcity

- Declining Mine Production: Many silver mines are reaching their peak production levels, leading to a decline in new silver discoveries. Major mining companies have reported reduced output due to depleted reserves and lower ore grades. This trend is expected to continue, exacerbating the scarcity of silver.

- Increasing Industrial Demand: Silver is a critical component in various industrial applications, including electronics, solar panels, and medical devices. The growing demand for these products, driven by technological advancements and renewable energy initiatives, has significantly increased the industrial consumption of silver. For instance, the photovoltaic industry alone consumed approximately 100 million ounces of silver in 2020, a number projected to rise in the coming years (Silver Institute, 2021).

- Geopolitical Influences: Political instability and regulatory changes in key silver-producing countries can disrupt supply chains and impact global silver availability. Countries like Mexico and Peru, which are among the largest silver producers, have faced such challenges, affecting their output and contributing to the overall scarcity.

Impact on Silver Prices

The scarcity of silver has a direct impact on its prices. As supply dwindles and demand remains robust, the price of silver tends to rise. Historical data shows a strong correlation between periods of reduced silver production and increased prices.

For example, during the economic recovery following the 2008 financial crisis, silver prices surged from around $10 per ounce in 2008 to nearly $50 per ounce in 2011 (Kitco, 2021).

Investment Opportunities

- Hedge Against Inflation: Silver has long been considered a hedge against inflation. In times of economic uncertainty and currency devaluation, silver retains its value and can provide a safeguard against inflationary pressures. This characteristic makes it an attractive investment for diversifying portfolios and protecting wealth.

- Industrial Growth: The expanding use of silver in industrial applications presents a significant investment opportunity. As industries such as electronics and renewable energy continue to grow, the demand for silver will likely increase, driving its value higher. Investors who recognize this trend can benefit from the rising industrial demand.

- Safe Haven Asset: Like gold, silver is often viewed as a safe haven asset during periods of geopolitical and economic turmoil. Its intrinsic value and limited supply make it a reliable store of wealth. Investors seeking stability in uncertain times often turn to silver as a secure investment.

Why This Matters to Indian Investors

India has a long and cherished relationship with silver. From intricate jewelry to revered idols, the metal has been woven into the very fabric of our culture. But here's the thing: silver's potential extends far beyond its ornamental value.

As the global economy embraces clean energy solutions and technological advancements, the demand for silver as an industrial metal is skyrocketing.

Remember that photovoltaic cells, the heart of solar panels, require significant amounts of silver. With India's ambitious renewable energy goals, the domestic demand for silver is poised for a significant rise. This presents a unique opportunity for Indian investors to capitalize on a global trend with a local connection.

Scarcity vs. Price: A Cause-and-Effect Dance

Now, the question on everyone's mind: how will this scarcity impact the price of silver? While the relationship isn't always a perfectly straight line, history suggests that limited supply often leads to price appreciation.

We've witnessed similar dynamics at play in the past, with silver prices surging during periods of undersupply.

Conclusion

The scarcity of silver is a critical factor that shapes its market dynamics and investment potential. As mine production declines and industrial demand rises, the value of silver is likely to increase. This presents a unique opportunity for investors to leverage silver's role as a hedge against inflation, a driver of industrial growth, and a safe haven asset.

Investing in silver requires a comprehensive understanding of market trends, geopolitical influences, and technological advancements. By staying informed and recognizing the impact of silver scarcity, investors can make strategic decisions that capitalize on silver's long-term value.

Silver remains a valuable asset, not just as jewelry, but as a critical component of our modern economy. Its scarcity and growing demand make it an essential element of any diversified investment portfolio. By understanding the impact of silver scarcity, you can make informed decisions and harness the potential of this precious metal.

Beyond the Blog: Deepen Your Silver Knowledge

For those interested in exploring further, I recommend visiting the Silver Institute's website for in-depth reports and market analysis. Additionally, keeping an eye on Kitco's silver price charts can provide valuable insights into market trends and price movements.

Stay tuned for my upcoming blog posts, where we'll delve deeper into silver investment strategies and explore specific opportunities. Until then, happy investing!