July 15, 2024

Silver Prices Forecast: Bullish Momentum in Uncertain Times

In the world of precious metals, silver stands out not just for its luster but for its multifaceted utility and potential as an investment. With experience in the Indian stock market and a deep dive into silver investments, I can confidently say that the current trends suggest a bullish momentum for silver prices.

This blog aims to elucidate the reasons behind this positive forecast and help you understand why silver is more than just jewelry; it’s a valuable asset in uncertain times.

So, whether you're a seasoned investor or just starting out, join us as we unveil the potential of silver beyond the sparkle and shine.

Let's unlock the power of this precious metal and see how it can contribute to your financial well-being.

The Silver Market Landscape

Silver has always been seen as gold's more affordable sibling. However, its industrial applications, coupled with its status as a precious metal, give it a unique position in the market.

The current landscape shows several factors contributing to a bullish momentum for silver prices.

1. Industrial Demand

Silver's extensive use in industries such as electronics, solar panels, and medical instruments is a significant driver of its demand.

According to the Silver Institute's 2024 report on Industrial Demand for Silver [1], industrial demand is projected to grow by 9% in 2024, driven by the green energy sector and technological advancements.

2. Economic Uncertainty

In times of economic uncertainty, investors flock to precious metals as safe-haven assets. The ongoing geopolitical tensions and economic challenges have increased demand for silver as a hedge against inflation and currency devaluation.

Historically, silver has performed well during economic downturns, and current trends suggest a repeat of this pattern.

Current Market Trends

To provide a clearer picture, let's delve into the recent trends and statistics that underscore the bullish momentum in the silver market.

1. Price Performance

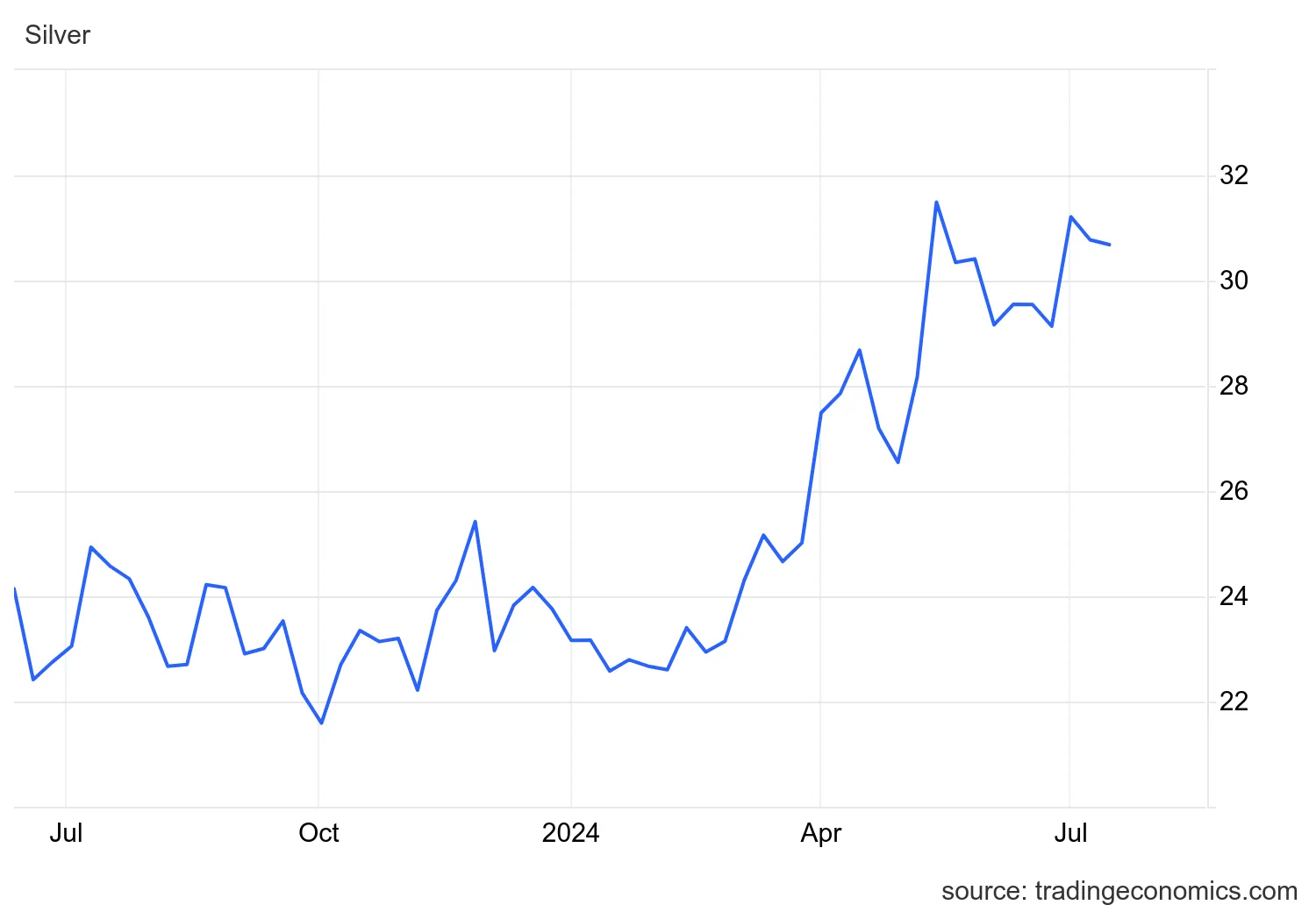

Silver prices have shown a steady increase over the past year. As of June 2024, silver is trading at around $28 per ounce, up from $23 per ounce in the same period last year (Trading Economics).

This upward trend is expected to continue, with some analysts predicting prices could reach $35 per ounce by the end of 2024 (Forbes).

2. Supply Constraints

Global silver production has faced constraints due to mining disruptions and declining ore grades. This supply crunch is further exacerbated by increasing demand, creating a favorable scenario for price appreciation.

The global silver mine production is expected to decline by 3% in 2024 (Silver Institute).

The Indian Context

India has a rich history of silver usage, primarily in jewelry and artifacts. However, the investment landscape for silver in India is evolving rapidly.

1. Investment Demand

The Indian market has seen a surge in silver investments, with investors looking to diversify their portfolios.

The introduction of silver ETFs (Exchange Traded Funds) has made silver more accessible to retail investors. First Half 2024 Sees 15% Increase in Silver ETF Holdings (IBJA).

2. Cultural Significance

Silver's cultural significance in India cannot be understated. It is not only a symbol of wealth but also an auspicious metal, often gifted during festivals and weddings.

This cultural affinity ensures a steady base demand, adding to the overall bullish sentiment.

Why Silver is a Valuable Asset?

Silver's value proposition goes beyond its price movements. Here are a few reasons why silver should be a part of your investment portfolio:

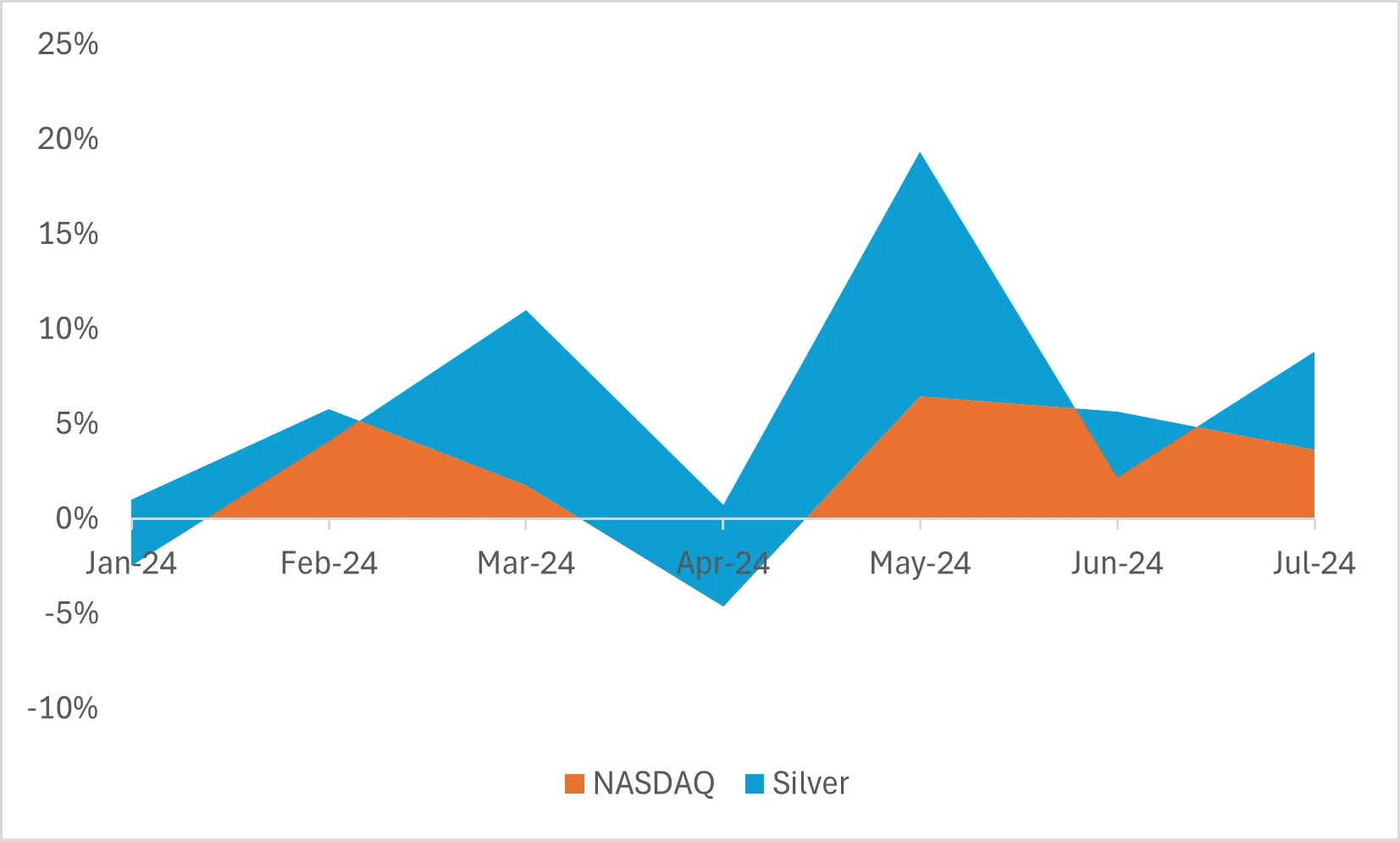

1. Diversification

Silver provides diversification benefits, reducing overall portfolio risk. Its performance often inversely correlates with equity markets, providing a hedge during market downturns.

2. Inflation Hedge

Silver has historically acted as a hedge against inflation. During periods of high inflation, silver prices tend to rise, preserving purchasing power.

3. Industrial Growth

The ongoing industrial revolution, especially in renewable energy and technology sectors, ensures a sustained demand for silver. The transition to green energy, in particular, is expected to drive silver demand for years to come.

Conclusion

The silver market is poised for a bullish run amidst uncertain times. Its unique blend of industrial utility, cultural significance, and investment appeal make it a compelling asset. By understanding these trends and incorporating silver into your investment strategy, you can harness its potential for wealth preservation and growth.

Remember, investing in silver is not just about capitalizing on price movements but also about appreciating its intrinsic value and multifaceted applications. As always, stay informed, stay invested, and let silver shine in your portfolio.

Remember: Conduct your own research and due diligence before making any investment decisions.