June 17, 2024

Silver Surges: Silver turns to shine after the gold rush

Silver prices are soaring in 2024, reaching record highs due to booming industrial demand for clean energy and electronics, and fueled by global geopolitical tensions. Investors are flocking to silver as a safe-haven asset, pushing prices even higher.

Silver is stealing the spotlight

Prices have skyrocketed, shattering records and captivating investors globally. It is silver’s turn to shine after the gold rush to record high prices.

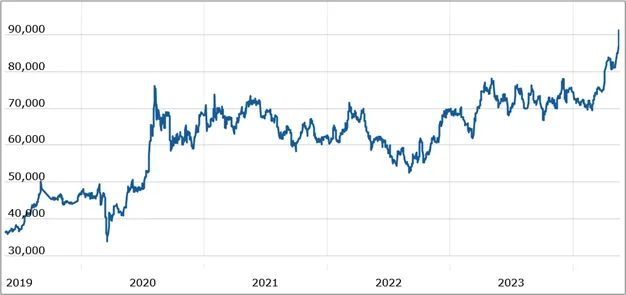

In India, on May 16, 2024, silver prices on the Multi Commodity Exchange (MCX) hit an all-time high of Rs 87,476 per kilogram (Zee Business).

Silver as a commodity has been breaking its all-time-high record since and as on 19-May it is trading at 91,150 per kilogram (MCX), with a remarkable 23% gain this year.

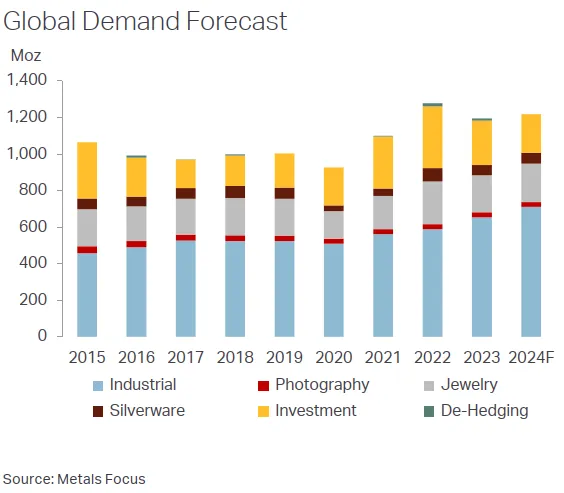

Globally, the sentiment around silver is similarly optimistic. Silver demand is expected to reach 1.2 billion ounces in 2024, highlighting its strong investment appeal amidst market uncertainties (Kitco).

For the first time in eleven years, silver prices are forecast to average around $33 per ounce in 2024, and potential to exceed $35 per ounce (MarketWatch).

But what's driving this silver surge? It is driven by two main factors:

1. Industrial Demand

Forget silver spoons – think solar panels, and smartphones! Silver's unique properties make it vital for clean energy and electronics. As the world embraces green tech and gadgets galore, silver demand is skyrocketing and is expected to grow.

According to the Silver Institute, the photovoltaic industry consumed an estimated 10,000 metric tons of silver in 2023, a figure projected to grow at a compound annual growth rate (CAGR) of 6.7% by 2028. This translates to a potential demand increase of over 700 tons annually.

2. Geopolitical Tensions

While factories churn out more silver-led devices, the global landscape remains unstable. Geopolitical tensions and conflicts can disrupt supply-chain, making investors nervous.

In such times, investors seek safe havens for their money. Silver, with its dual role as an industrial and precious metal, becomes a hot commodity.

As per Nasdaq, silver prices are rising as tensions in Middle-East and other parts of the world escalate.

Small traders are betting on continued conflict to drive prices higher, creating a short-covering rally.

Despite big traders focusing on potential rate hikes and a strong dollar, the immediate effect of geopolitical unrest is boosting silver's value.

Read this:

Combined Force for Silver's Rise

The combination of booming industrial demand and geopolitical jitters – are working together to propel silver prices to new highs.

The rising demand creates a sense of scarcity, while global uncertainties make silver a more attractive asset for investors seeking to hedge against market volatility.

The hot combination of rising demand and potential supply constraints has caught the eye of investors. They're buying silver like never before, further pushing prices upwards.

The Silver Lining

As silver continues its meteoric rise in 2024, driven by surging industrial demand and geopolitical tensions, it poses a tantalizing opportunity for investors.

The allure of this precious metal as both a crucial industrial component and a safe haven asset cannot be understated. However, with great potential comes significant volatility.