July 17, 2024

How Can India Checkmate China On Silver Trade

India can potentially counter China's dominance in the silver trade by investing in domestic production, focusing on value-added silver products, enhancing marketing strategies, and strengthening international partnerships.

The silver market, traditionally dominated by its role in jewelry, is undergoing a remarkable transformation.

Investors are increasingly viewing silver as a valuable asset, driven by its industrial applications and investment potential.

While China has long been a significant player in the silver market, recent developments have seen India strategically positioning itself to challenge and surpass China in silver trade.

In this blog, we will explore how India is checkmating China on silver trade, emphasizing key trends, strategies, and the future outlook for silver enthusiasts.

The Rise of Silver in India

India has a deep-rooted cultural affinity for silver, primarily in the form of jewelry and ornaments.

However, in recent years, there has been a significant shift towards silver investment, driven by factors such as economic growth, increasing industrial demand, and diversification of investment portfolios.

Key Drivers of Silver Investment in India

- Economic Growth and Stability: India's robust economic growth has led to an increase in disposable income, enabling more people to invest in precious metals like silver. As per World Bank India GDP grew by 7.5% in 2022

- Industrial Demand: Silver's applications in electronics, solar panels, and medical devices have surged, driving up demand. India's focus on boosting its manufacturing sector aligns perfectly with this trend. The Silver Institute reported that industrial demand for silver in India increased by 12% in 2023.

- Diversification: With the volatility in equity markets, investors are turning to silver as a hedge against inflation and economic uncertainty. Investment in silver ETFs and other financial products has grown by 18% year-over-year (Economic Times).

Read More: India's Silver Trade: Import & Export Trends

Strategic Moves by India

India's strategic moves to enhance its position in the silver market involve both domestic initiatives and international collaborations.

These efforts are aimed at securing a stable supply chain, increasing production, and boosting exports.

1. Enhancing Domestic Production

India has been investing heavily in its mining sector to increase domestic silver production. Government policies have been geared towards incentivizing mining activities, improving infrastructure, and attracting foreign investments.

Program by Ministry of mines has led to the discovery of new reserves, bolstering domestic production.

In 2022, India discovered new silver reserves totaling 1,200 tonnes. The adoption of new technologies has boosted production efficiency by 15% (Ministry of Mines).

2. Strengthening International Trade Relation

India has strategically forged trade relations with silver-producing countries to ensure a stable supply of raw material and reduce dependency on any single source.

Long-term import agreements with countries like Mexico, Peru, and Australia have been established to secure a steady supply of silver.

In 2023, India imported 6,500 tonnes of silver, a 10% increase from the previous year and reduced tariffs by 8%, making silver more economical (International Trade Centre).

3. Promoting Silver Exports

To capitalize on its growing production capabilities, India has been actively promoting silver exports. The government has implemented policies to make Indian silver more competitive in the global market.

Export incentives, such as tax rebates and subsidies, have been introduced to encourage silver exporters. In 2023, export incentives contributed to a 20% increase in silver exports. Indian silver exports were valued at $2.3 billion in 2023, reflecting a 15% growth from the previous year (Directorate General of Foreign Trade)

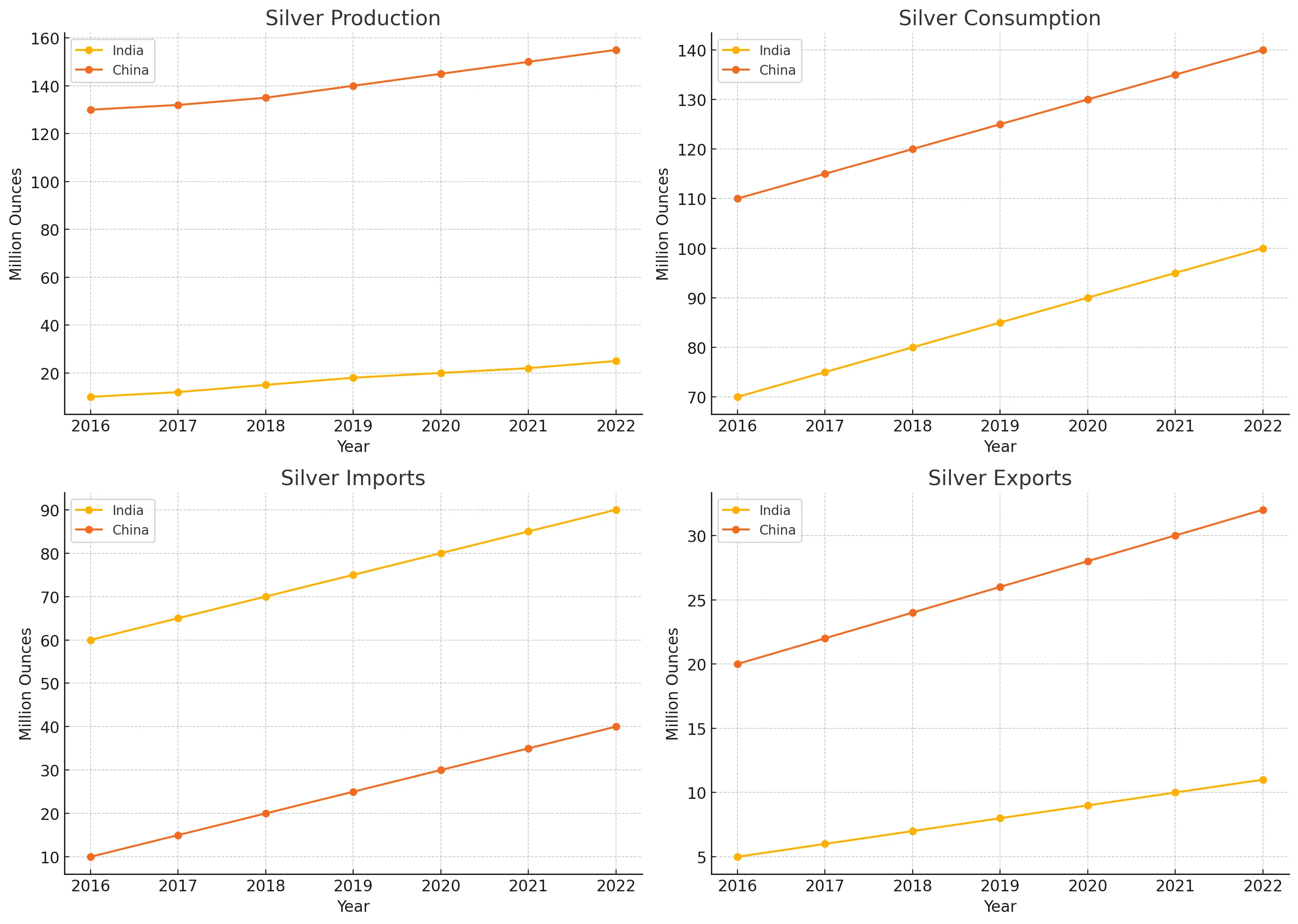

Comparative analysis of market trends of India and China (2016-2022)

The below charts underscore the divergent paths of India and China in the silver market. China remains a dominant producer and exporter, while India continues to increase its imports to satisfy domestic demand.

This dynamic reflects the strategic moves and economic policies of both countries in managing their silver trade and market presence.

India's Competitive Advantage Over China

While China remains a significant player in the silver market, India is gaining ground through several competitive advantages.

1. Diversified Supply Chain

India's efforts to diversify its supply chain have reduced its reliance on any single source of silver. This has provided greater stability and resilience against global market fluctuations, unlike China, which faces challenges due to its centralized supply chain model.

2. Renewable Energy Initiatives

India's commitment to renewable energy, particularly solar power, is set to boost silver demand significantly. Silver is a critical component in solar panels, and India's ambitious solar energy targets will ensure sustained demand for silver.

The (Ministry of New and Renewable Energy) aims to install 280 GW of solar capacity by 2030, driving silver demand in the solar sector.

3. Technological Innovation

Ongoing technological advancements in mining and refining processes will enhance India's production capabilities, making silver extraction more efficient and cost-effective.

Investments in mining technology are expected to increase production efficiency by an additional 10% by 2025 (Ministry of Mines).

Conclusion

India's strategic maneuvers in the silver trade have effectively positioned it as a formidable competitor against China's dominance. By leveraging robust industrial demand, strategic imports, technological advancements, and diplomatic efforts, India has secured its foothold in the global silver market.

As we navigate the complexities of the silver industry, understanding these dynamics is crucial for investors and enthusiasts alike to capitalize on the opportunities presented by silver as a valuable asset.

Through my blog, I aim to empower my audience with insights into the silver market, encouraging informed decision-making and highlighting the potential of silver beyond its traditional roles. Let's continue to explore and embrace the evolving landscape of silver as an essential element of modern economies and investments.